Maximizing Insurance Claims After a DUI Accident

Filing Insurance Claims After a DUI Accident is challenging due to policy exclusions and legal conse…….

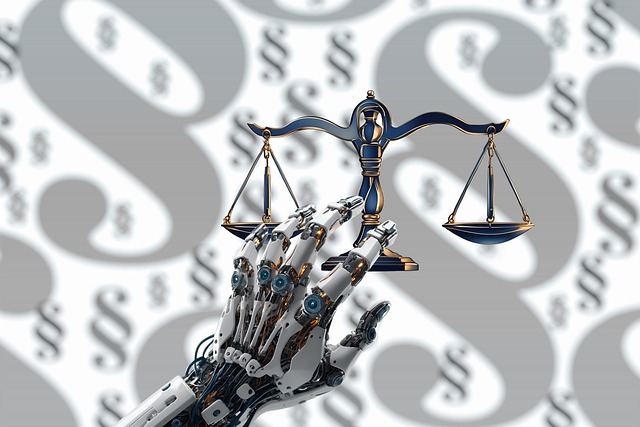

In the intricate web of personal responsibility and legal consequences, insurance claims following a DUI (Driving Under the Influence) accident stand as a critical aspect for individuals and societies alike. This comprehensive guide aims to unravel the complexities surrounding these claims, offering insights into their multifaceted nature. We will explore how these claims shape post-accident scenarios, impact financial landscapes, and influence legislative frameworks worldwide. By delving into this topic, we empower individuals to make informed decisions and navigate the legal and insurance sectors effectively after a DUI incident.

Definition: Insurance claims resulting from a DUI accident refer to the process of an insured individual filing a demand for compensation or reimbursement with their insurance provider following a driving-related incident involving alcohol or drugs. This claim triggers a series of legal and financial procedures aimed at resolving damages, medical costs, and liability.

Key Components:

Historical Context:

The concept of insurance claims after DUI accidents has evolved significantly over the past few decades. Initially, insurance companies were reluctant to provide coverage due to the heightened risks associated with impaired driving. However, as legislation and public awareness regarding DUI offenses strengthened, insurance policies began to include specific clauses addressing these incidents. This shift led to the development of specialized insurance products tailored to drivers facing DUI-related claims.

The influence of insurance claims after a DUI accident extends far beyond borders, with varying trends observed across different regions:

| Region | Trends | Challenges |

|---|---|---|

| North America | Strict laws and stringent insurance requirements for DUI offenders. High awareness campaigns have led to increased reporting of such incidents. | High cost of insurance for repeat offenders, impacting their financial stability. |

| Europe | Diverse approaches across countries, with some having mandatory insurance for all vehicles, while others focus on driver behavior. | Inconsistent application of policies due to varying legal frameworks. |

| Asia Pacific | Rapid urbanization and increasing motorization have led to a rise in DUI-related claims. Insurance companies are adapting their policies accordingly. | Lack of standardized legislation across countries, making cross-border claims complex. |

| Middle East | Strict penalties and high insurance requirements similar to North America. The region witnesses a significant number of claims due to its young population and vibrant nightlife. | High insurance premiums can deter responsible driving behavior. |

| Latin America | Variable insurance coverage depending on local regulations. Public awareness campaigns are gaining momentum. | Limited access to quality insurance in rural areas, leaving drivers vulnerable. |

These regional variations highlight the dynamic nature of DUI insurance claims, influenced by cultural, legal, and socio-economic factors.

Market Dynamics: The global insurance market for DUI claims is a niche yet significant segment. According to a 2022 report by Global Market Insights, this market is projected to surpass USD 50 billion by 2030, reflecting the growing incidence of DUI accidents globally. This growth is driven by increasing alcohol consumption, rising vehicle ownership, and stringent legal frameworks.

Investment Patterns: Insurance companies investing in DUI-related products often focus on risk assessment and management. They employ advanced analytics to predict and mitigate risks associated with impaired driving. These investments have led to the development of innovative risk modeling tools and specialized insurance policies.

Economic Impact: For individuals, DUI accidents can have severe financial repercussions. The cost of insurance claims, legal fees, and potential criminal penalties can be substantial. In some cases, these expenses may lead to long-term financial strain, especially for low-income earners. Governments also bear indirect economic costs through increased healthcare spending and road safety initiatives.

Telematics and Telehealth: The integration of telematics data into insurance claims processes has revolutionized risk assessment. Insurers can now analyze driving behavior in real time, enabling more precise pricing and claims management. Additionally, telehealth services have made post-accident medical consultations more accessible, especially for individuals in remote areas.

Advanced Driver Monitoring Systems (ADMS): These systems, installed in vehicles, monitor driver behavior and can detect signs of impairment. They have the potential to reduce DUI incidents by providing real-time feedback and alerts. Insurance companies are exploring partnerships with technology providers to incorporate ADMS data into their claims assessments.

Blockchain for Claims Processing: Blockchain technology offers enhanced security and transparency in claims processing. It enables secure storage of medical records, vehicle history, and policy details, streamlining the verification process and reducing fraud.

DUI accidents trigger a series of legal consequences:

To mitigate the impact of DUI accidents, several preventive measures are in place:

Insurance claims after a DUI accident are a complex interplay of legal, financial, and technological factors. Understanding this process is crucial for both individuals and society at large. As global trends indicate an increase in DUI-related incidents, the insurance sector continues to adapt, offering specialized products while advocating for responsible driving behavior. By staying informed and adhering to road safety regulations, individuals can navigate these claims processes with greater confidence, ensuring a more secure future.

Filing Insurance Claims After a DUI Accident is challenging due to policy exclusions and legal conse…….

Youth Justice systems focus on restorative practices and address underlying issues to reintegrate yo…….

Understanding insurance claims processes after a DUI accident is crucial for justice and amends. Pro…….

Navigating insurance claims after a DUI accident requires careful documentation and understanding po…….

First-time DUI offenders face challenges managing insurance after an accident. Many states offer &qu…….

Technology revolutionizes Insurance Claims After a DUI Accident by enhancing accuracy and efficiency…….

DUI accidents carry severe consequences, including potential employment impact. Insurance claims man…….

DUI convictions significantly impact immigration status and insurance claims. Green Card holders fac…….

DUI accidents severely impact insurance premiums for first-time offenders due to increased risk prof…….

Alternative sentencing for DUI offers flexible justice with focus on rehab and community involvement…….